5 Accounting Services Your Business Can Outsource

Overview

Do you know who an accountant is? An accountant is someone who solves a problem you didn't know you had in a way you don’t understand. All jokes aside, this is one of the most responsible and demanding tasks in the world of business. No one can avoid it because laws make it mandatory to register and track every single financial as well as economical operation.

Accounting services tend to be costly and thus, it is a wise decision to consider outsourcing them. You may run into a dilemma of whether it is beneficial to outsource everything or just specific services. Which would be the most practical and least cost-demanding way? Read the article to know all about it.

Outsourcing accounting – save thousands every month

Accounting, out of all business services, is pretty similar all over the Western world. The rules (applicable taxes and their rates) might change, but the used software, document tracking as well as standard practices are very much alike. This is the premier reason why virtual accounting and remote accountants are starting to take off. The location of your accountant frankly does not influence the accuracy and quality of their work.

The second factor of why it is worth outsourcing is cost. Accounting and finances are a costly venture. Since they are mandatory, such expenses cannot be avoided. Nevertheless, with outsourcing, businesses big or small can save a substantial sum of money by preferring virtual accounting over physical. Let’s compare the costs of virtual and in-house accounting for three random firms. The conditions are simple. In each case, the firm needs 45 hours of accounting work to make sure all tasks are completed. This is how this translates into numbers.

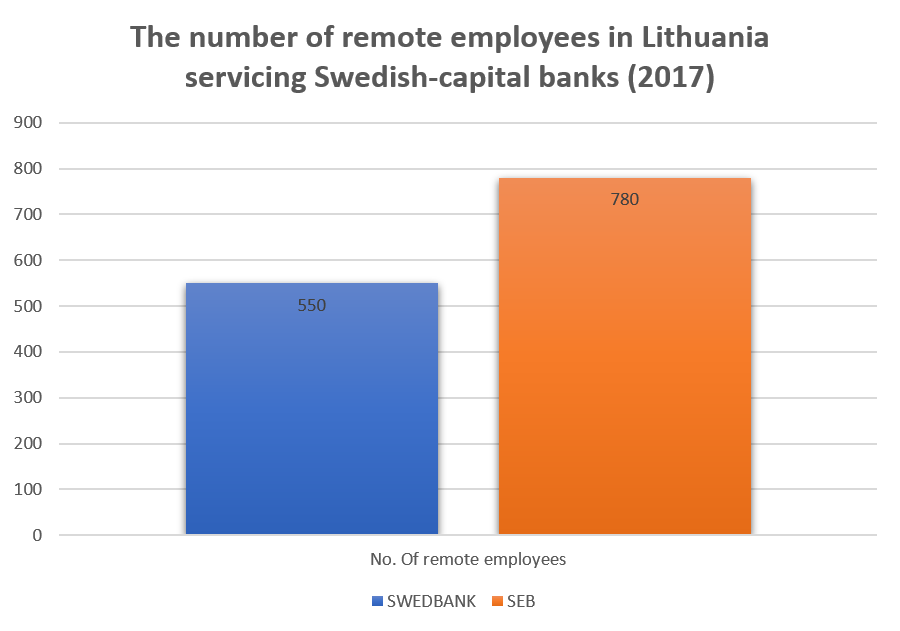

The chart shows the comparable expenses of employing an equal amount of in-house and virtual accountants. The data taken was for the average in-house accountant salary in Denmark and the relative standard cost for virtual accounting services. The virtual accounting option saves you from the taxes which burden when hiring in-house. The latter option amasses to around 5 thousand euros per month. It is also significantly cheaper than hiring an accounting firm to handle your business. They usually charge 50-90 euros per hour (The example shows 75 euros per hour). Every month a regular Danish company can save hundreds or even thousands of euros. For bigger businesses, results are even more overwhelming. Of course, the saved amount depends on the rate which the virtual agent or agency charges and other related costs but taken all into account, with proper nearshoring and remote employment solutions, the benefits will be staggering.

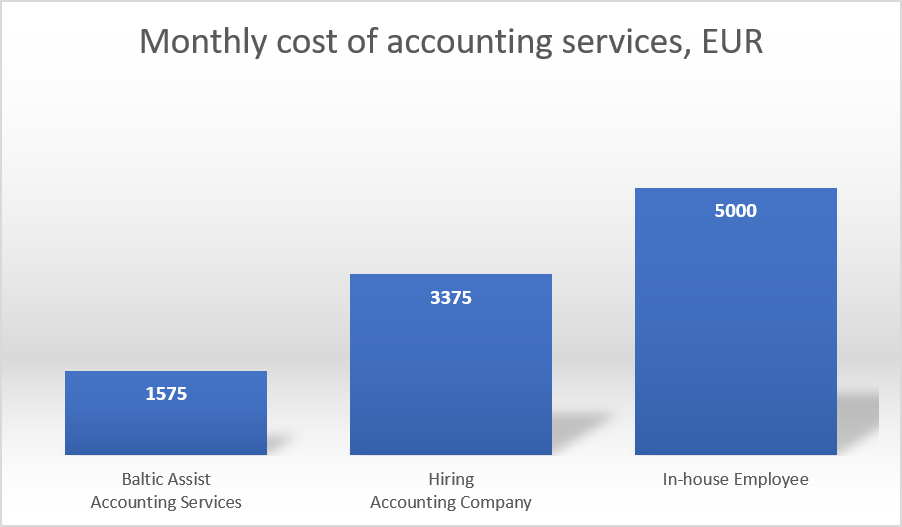

What is more, an established virtual accountant could lead to the creation of your own virtual office. Customer service, remote teams, and other areas could be adequately supplied via virtual agents and nearshoring virtual agency solutions. A great example is the largest Swedish banks of Swedbank and SEB, which operate in the Baltics. They both have large service centers here, dedicated to only working and supporting the Swedish department, which means that they value outsourcing and nearshoring and see their benefits. These banks are multi-billion Euro companies. Is there any reason why you should not try the same thing?

Channel saved funds – strengthen your business

Let us piggyback on the example in the chart above. Let us presume that your business saved around 3 thousand per month by choosing to outsource accounting. During the year, that is 36 thousand euros in reduced expenditures. For any business, this sum is no joke and is worth at least considering. You can choose to test virtual accounting out, before fully committing.

Those thousands of saved Euros could be diversified, reinvested into the company, paid out as dividends or bonuses, saved as assets, etc. The primary reason for outsourcing is reducing labor costs without having a decline in the quality of work. It’s a win-win situation for your company.

Besides, virtual accountants can be called out to your HQ at any time. You can arrange training, meetings, conferences, as well as participation in corporate events to fully include your remote employees. Nearshoring means that flight and travel costs are not going to be that big and knowing the language will allow fluid and efficient communication. The employer can train and expand the qualifications of their virtual accountants if they wish. Whichever way you want to go, you can always consult with the service provider to optimize processes and boost performance.

Precise accounting tasks worth outsourcing

There are numerous accounting services which are worth outsourcing. It is one of our essential services and remains integral to the core of our business. Service providers can offer a variety of particular tasks or focus on a single, whole-engulfing accounting approach. Amongst the most popular and recognized are:

1. Accounting and bookkeeping

For every business, proper books are not just necessary; they are mandatory if the company wants to grow and expand. By knowing expenditures, analyzing cash flow and optimizing the number of transactions, an organization can save substantial sums over short and long periods of time. Virtual accounting and bookkeeping manage initial set-ups, inventory and asset accounting, VAT and expense reports as well as other related actions.

2. Payroll services

Managing and carrying out payroll on schedule can be stressful if there is a shortage of resources in the accounting department. Data has to be filled, reports generated, taxes calculated, and proper sums allocated. These combined processes require people regularly on the job and continuous monitoring. A much cheaper way to handle these operations for your company is just to outsource payroll services. Salary payment is a must-do. Your employees and workforce are the most reliable resource which has to be cared for.

3. Preparation of statements/reports

Virtual accountants can prepare and generate financial as well as management statements/reports. Such documents are highly valuable to your company since they provide clear statistical insight and allows us to forecast into the future. Specific reports are necessary for banks or investors while statements have to be mandatorily handed into tax inspection services and other government institutions. If these documents are in order, your business has a higher chance of being profitable and out-competing others. Virtual accountants can prepare monthly, quarterly and another periodical financial, cash flow, consolidated financial reports, specific management reports, arrange archived books from earlier periods, estimate and calculate CIT (corporate income tax) as well as other related services.

4. Payment processing services

This is an area where there is simply no room for errors. You do not want to miss a mistake in your invoice or the client’s transaction. Virtual accounting services can take care of cash transfers and cash exchange as well as arrange invoicing, payment of invoices, etc.

5. Corporate secretarial services

Corporate and business documentation is in the core of bureaucracy. Administrative work is equally as important as technological or analytical tasks. Without the proper administration papers and documents would be lost, businesses would struggle, and many companies (especially larger ones) would fall into disarray. To avoid that, secretaries, administrators, managers are hired. These positions cost a lot. What does not, however, is a virtual assistant.

A competent and well-trained staff member, which you can personally select will handle corporate documentation, manage and carry out correspondence-related matters as well as store data, keep registers of employees. This would be a massive relief from in-house shoulders.

If you see many cons

Yes, accounting work requires excellent accuracy, dedication, and experience. However, as mentioned before, the documentation across the EU and the EEE is very similar. When the distance between your country of operation and the location of the virtual assistant is huge, there could be specific issues. However, nearshoring almost eliminates them and provides arguably no trouble communicating, delegating tasks, working things out, etc. Yes, the differences exist, but specialists can be trained to understand new sets of documentation, learn new tax rates and other things.

All in all, with proper patience, outsourced virtual accounting works with all location combinations. Yet, why waste money when there are time-tested virtual accounting solutions close-by? We wonder too.

Afraid of a lack of skills from the virtual agent? You should not be, mainly if you deal with the Baltics. Even though they are quite new countries, the three Baltic Sisters of Lithuania, Latvia and Estonia are amidst rapid economic growth and development. Fun facts - Lithuania ranks as the country with most university graduates per capita in the EU. Also, Lithuanians (on average) speak 2.7 languages, tied for 2nd most in the EU. By hiring a virtual accountant from the Baltics, you will always get a competent, trained, eager to learn and highly motivated specialist who will execute the tasks you delegate. The best part about it – their services are much more affordable than your local workforce!

Don’t stay behind – go virtual and be ahead

In this line of work, with computers and digital documentation, as well as cloud solutions, becoming more and more prominent, the idea for being in-house to provide accounting services is outdated. Yes, the concept may seem appealing and welcomed in many businesses, but as we illustrated above, you can save enormous amounts of money which would otherwise be dedicated to the accounting workforce. On average, a mid-level accountant in Scandinavia can earn upwards of 3 thousand euros. An equally competent virtual accountant from a close-by country, for example, in the Baltics, would cost 50-60 percent less. However, providers offer an even better option of paying an hourly fee. Smaller and medium sized-businesses might not need a full-time employee or a team of accountants, so virtual accounting becomes much welcomed. You pay a flat/fixed hourly fee instead of maintaining an employee which would be sitting with nothing to do for half of the time. This can save as much as 70% of your regular costs in payroll expenses.

Nearshoring is the prime and best example of how remote accounting works. The close distance between the two countries means that there are little cultural and time differences and thus no struggle to communicate or delegate tasks, occur. Let us give a typical example. A business in Scandinavia is looking for reliable, high-quality, but not too costly accounting solutions. However, they want to remain hands-on with the selection process to make sure they are hiring the right person. What is the best thing to do? Of course, it’s going virtual!

Moreover, with the in-house hiring, the process could take many weeks or even months. Virtual agencies usually have the right connections and can arrange proper interviews much quicker. Your employee will set off and start working almost immediately.

Conclusion and Recommendation

If you are thinking about virtual accounting, we strongly recommend that you do not hesitate! Go for it. You will see the benefits straight away and in the long-run. Financial breathing room or the ability to diversify funds, channel them into R&D or other departments is a welcome addition any day of the week. Services like payroll management, statement preparation and bookkeeping could be handled at the lower costs if you nearshore and simply go virtual.

Are you in doubt whether to outsource your accounting services? or which accounting services are worth to outsource for your business? Schedule Free Consultation

Have a question?

Get in touch!

Baltic Assist provides a comprehensive outsourcing solutions that saves costs, enhances efficiency, and strategic decision-making for your business.