Lithuania can become not only a laser powerhouse, but also a services-export country

Lithuania can become not only a laser powerhouse, but also a services-export country

Lithuania’s next export engine: services that help close the goods deficit

Written by: Andžej Rynkevič

Overview

Lithuania likes to take pride in its lasers—and rightly so. Our laser companies are world-class, and their products are used in leading universities and laboratories worldwide. But a bigger transformation has been reshaping Lithuania’s economy with far less fanfare: Lithuania is becoming a serious exporter of services.

In the third quarter of 2025, Lithuania’s services exports reached EUR 6.6 billion, up 13.3% year-on-year. More importantly, services generate a meaningful surplus: in Q3 2025, the services balance surplus reached EUR 2.7 billion (around 12.1% of quarterly GDP). In plain terms, services exporters are helping cover the gaps in goods trade and strengthening Lithuania’s current account.

This shift is visible not only in macro data but also in who is creating value at scale. Among the largest taxpayers we increasingly see companies like Vinted and Nord Security—businesses built on exporting services. That’s a signal of something fundamental: Lithuania’s export strength today is not only what we ship in boxes, but what we deliver through fiber-optic cables—knowledge, expertise, and high-value intellectual work.

Services are already strengthening Lithuania’s economy

Bank of Lithuania data show that transport still makes up the largest share of services exports (roughly in the mid 40% range), but the most exciting progress is happening in high value-added segments: ICT, financial services, and modern business services.

And here’s the key: with goods, Lithuania often runs a deficit—we import more than we export. With services, Lithuania earns a surplus. That surplus is increasingly the stabilizer that lets the economy grow without relying on a perfect balance in physical trade.

From call centers to strategic partners

A few decades ago, Lithuania’s service-export story started with call centers. Today, the reality is different. Western companies increasingly choose Lithuania not primarily to save money, but to gain quality, reliability, and competence.

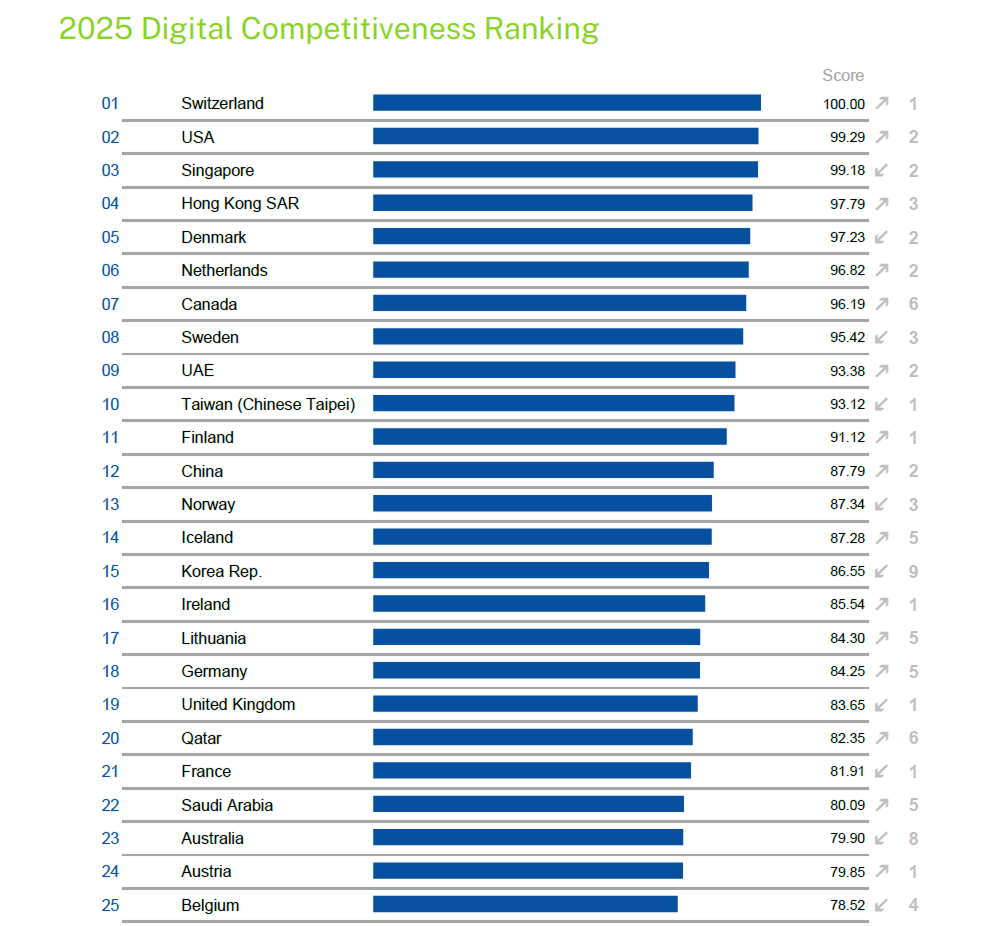

Lithuania’s rise to 17th place in the IMD World Digital Competitiveness Ranking, ahead of countries like Estonia, Germany, Austria, and the United Kingdom, reflects this shift.

The same story shows up in talent and wages. According to Unicorns Lithuania, average salaries in Lithuanian startups are far above the national average. That is not “cheap labor.” And it shouldn’t be. Lithuania cannot—and should not—compete with Asia on price.

Our export product is high-quality problem solving.

What I see in practice is that Lithuanian teams no longer perform only routine tasks like data entry. They take ownership of complex processes: finance operations, accounting and reporting, customer success, project coordination, and business development. More and more, international companies view Lithuanian teams not as “support staff,” but as partners who can make decisions independently.

A simple (anonymized) example from the market: a fast-growing Northern European company that initially outsourced basic support work to Lithuania gradually expanded the scope to include end-to-end customer operations and internal reporting. The turning point wasn’t cost—it was reliability, clarity of communication, and the ability of the team to improve processes proactively, not just execute tasks.

When a Scandinavian or U.S. company entrusts financial accounting or customer support to a team in Vilnius, they are not buying hours—they are buying peace of mind: predictable delivery, strong process discipline, and a shared business culture that works smoothly across borders.

High-tech and services: the real value is in the synergy

I often hear the argument that Lithuania must choose between manufacturing and services. I don’t agree—and the data doesn’t support it.

An Invest Lithuania report (2024) notes that by the number of jobs created, only business services outperformed the technology sector. And importantly, modern business services are not call centers. They include cybersecurity teams, FinTech compliance (AML/KYC) centers, and software development bases. Bank of Lithuania data also show that exports of financial services have grown dramatically since early 2022.

From my perspective, Lithuania’s competitive advantage is a combination of factors: a strong drive to prove our value, fast adaptation to new technologies, and flexibility.

For global corporations that struggle to move quickly, this matters. Large organizations are often slow to staff specialized projects fast. Lithuanian teams can integrate quickly, communicate smoothly in multiple languages, and solve problems proactively. Technology is important—but the human factor is what turns Lithuania into a world-class services hub.

What we should do next: a practical strategy for the future

If we want this momentum to continue, we need to start seeing ourselves—and presenting ourselves to the world—as a country of high-value-added, high-qualification professionals.

In my view, services exports should become one of Lithuania’s long-term strategic export priorities. That requires focus in three areas:

1) Education aligned with exportable skills

Lithuania needs not only engineers for factories, but also financial analysts, project managers, operations leaders, and multilingual customer service professionals.

What to do now: strengthen industry–university partnerships, expand work-study pathways, and scale programs that combine business fundamentals with data literacy and AI-assisted productivity.

2) A competitive, predictable tax environment for talent

Services exports are highly sensitive to labor taxation because the main “raw material” is people.

What to do now: keep the overall framework stable and competitive for high-skilled roles, improve clarity and incentives around employee equity/stock options, and reduce friction for attracting and retaining top specialists.

3) Stronger national positioning and reputation

The world already knows Lithuanian lasers. Now it’s time for more people to understand that Lithuania is also a place where international processes are managed exceptionally well.

What to do now: build a clear national narrative around “trusted European delivery,” showcase measurable outcomes (quality, speed, retention), and promote success stories beyond tech—finance ops, compliance, customer operations, and specialized support functions.

Lithuania has already proven it can create advanced technology. Now we are proving we can run global business processes—and judging by the billions in exports, we’re doing it successfully. The next step is confidence, consistency, and a stronger long-term strategy that turns today’s momentum into a durable export advantage.

Have a question?

Get in touch!

Baltic Assist provides a comprehensive outsourcing solutions that saves costs, enhances efficiency, and strategic decision-making for your business.